SMM News on May 29:

Price Review:

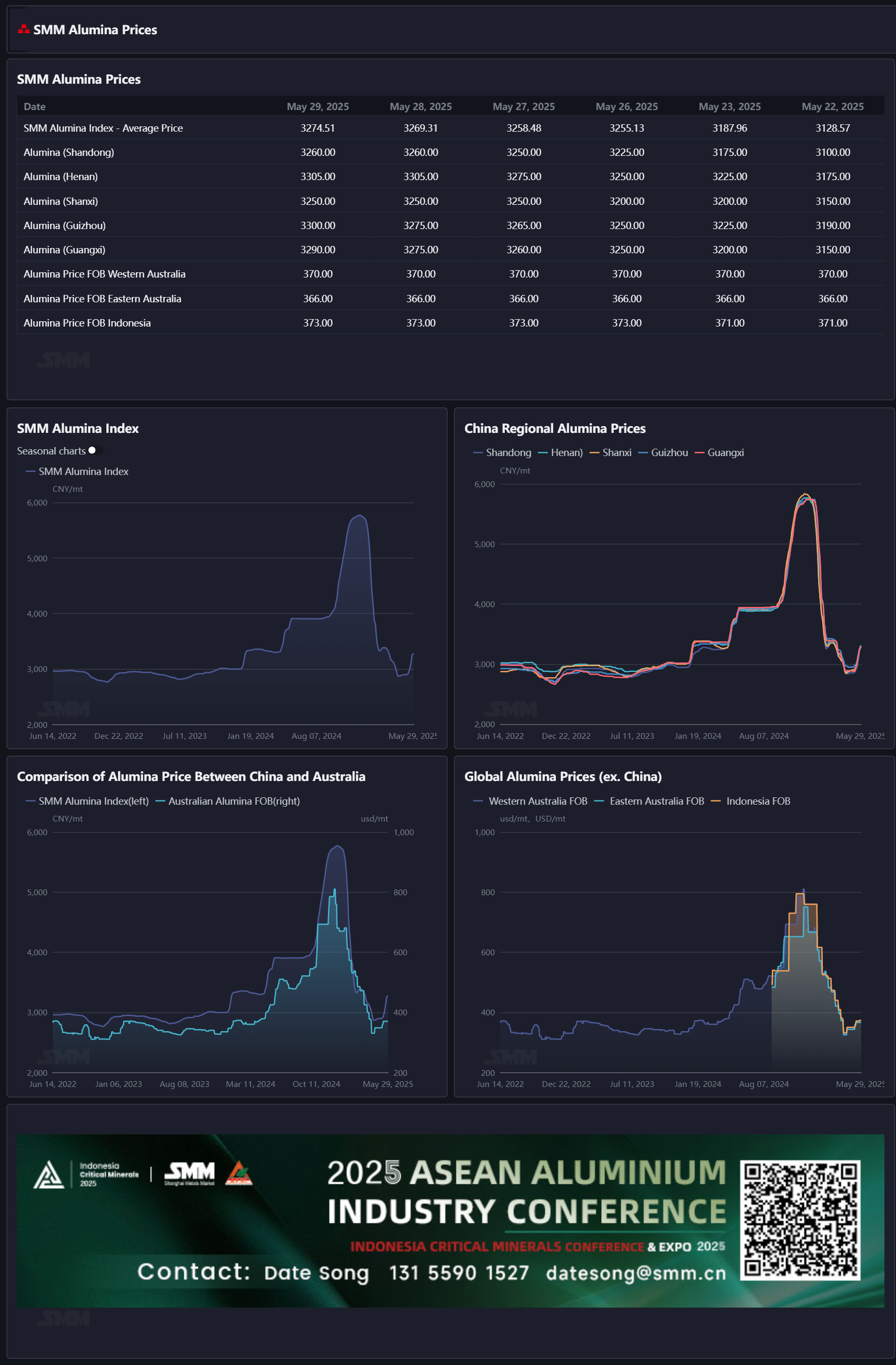

As of Thursday this week, the SMM alumina index stood at 3,128.57 yuan/mt, up 192.33 yuan/mt from Thursday last week. In Shandong, prices were reported at 3,220-3,300 yuan/mt, up 160 yuan/mt from Thursday last week; in Henan, prices were reported at 3,250-3,360 yuan/mt, up 130 yuan/mt from Thursday last week; in Shanxi, prices were reported at 3,250-3,330 yuan/mt, up 115 yuan/mt from Thursday last week; in Guangxi, prices were reported at 3,250-3,330 yuan/mt, up 140 yuan/mt from Thursday last week; in Guizhou, prices were reported at 3,250-3,350 yuan/mt, up 110 yuan/mt from Thursday last week; in Bayuquan, prices were reported at 3,210-3,290 yuan/mt.

Overseas Market:

As of May 29, 2025, the FOB Western Australia alumina price was $370/mt, with an ocean freight rate of $21.95/mt. The USD/CNY selling rate hovered around 7.21. This price translates to an approximate selling price of 3,272 yuan/mt at major domestic ports, which is 2 yuan/mt lower than the domestic alumina price, indicating a gradual opening of the alumina import window. This week, a spot alumina transaction was inquired overseas: On May 23, 30,000 mt of alumina was traded overseas at a transaction price of $373/mt FOB Indonesia, with a shipment scheduled for late July.

Domestic Market:

According to SMM data, as of Thursday this week, the total installed capacity of metallurgical-grade alumina nationwide was 110.82 million mt/year, with a total operating capacity of 86.67 million mt/year. The weekly operating rate of alumina nationwide rebounded by 0.19 percentage points WoW to 78.21%, mainly due to the completion of maintenance at some enterprises and the subsequent rebound in operating capacity. Specifically, the weekly operating rate of alumina in Shandong remained unchanged WoW at 89.30%; in Shanxi, it decreased by 2.6 percentage points WoW to 69.8%; in Henan, it rebounded by 3.33 percentage points WoW to 55.83%; in Guangxi, it rebounded by 5.71 percentage points WoW to 95.15%.

During the period, the upward trend in spot alumina transaction prices gradually slowed down, with more traders participating and fewer direct purchases by aluminum smelters. By region: Aluminum smelters in Xinjiang conducted tender purchases for some alumina, with delivery-to-factory prices around 3,590 yuan/mt; spot alumina transaction prices in Henan were 3,290-3,360 yuan/mt; in Shanxi, they were 3,300 yuan/mt; in Guangxi, they were 3,300-3,330 yuan/mt; in Guizhou, they were 3,350 yuan/mt.

Overall:

This week, the weekly operating capacity of alumina continued to rebound, increasing by 1.46 million mt/year WoW to 86.67 million mt/year. The pressure on spot supply further eased, and the upward trend in spot prices slowed down. Recent overseas alumina transactions have been sluggish, with relatively small price fluctuations. As domestic prices continue to rise, alumina imports have shifted from losses to profits, and the domestic alumina import window is gradually opening. In the short term, with the gradual resumption of production of some alumina capacity that was under maintenance and experiencing production cuts, the supply pressure of alumina is expected to gradually ease, and spot alumina prices are expected to enter a phase of volatile adjustment. In the future, it is necessary to continuously monitor changes in the capacity of domestic alumina enterprises, as well as the supply of imported alumina.